Lorenzo Tavazzi (Senior Partner and Head of the Scenarios and Intelligence and International Development Area of The European House - Ambrosetti)

Opportunità di sviluppo negli USA per le imprese italiane, lo studio di The European House - Ambrosetti

Last October 25 the Italian Embassy in Washington hosted the presentation of an extraordinary strategic study on development opportunities in the US for Italian companies, prepared by The European House - Ambrosetti (TEHA) and masterfully narrated in front of an audience of more than 100 Italian and American stakeholders by Lorenzo Tavazzi, Senior Partner and Head of the Scenarios and Intelligence and International Development Area of TEHA Group.

The study was commissioned by the Italian Embassy in Washington and ICE, and is a fundamental reference point for the past, present and future investment scenario between Italy and the United States. It is my pleasure to welcome to We the Italians Lorenzo Tavazzi, who combines enviable expertise with an equally pleasant courtesy.

In keeping with the TEHA Group tradition, your study is very interesting in terms of results and equally rigorous in terms of methodology. Please let's begin describing the latter.

The study encompassed a multi-level methodology, which included the reconstruction of a database with key social and economic figures of US states from 2000 with >3,600 datapoints; an in-depth performance analysis in 5 key sectors (Advanced Manufacturing, Energy, Aerospace, Life Sciences and Food & Beverage); the identification and analysis of >160 incentives and programs at federal and state level in the US; the identification of Italian companies investing in the US through ad hoc financial databases with >83,000 datapoints; the identification of US companies investing in Italy through ad hoc financial databases with >74,000 datapoints; and finally the analysis of trade relations between Italy and 51 US states and key bilateral trends related to Foreign Direct Investments and foreign companies from 2017.

Can you provide some specific data or statistics that highlight the sectors and the areas in which Italian companies are experiencing the most success in the US?

TEHA estimates that Italian companies investing in the US collectively generate up to $140 billion in revenue and involve up to 300,000 employees.

The following is the evidence that emerges from the analysis of the companies that provide economic and location data, and thus may be discrepant from what is shown above.

Forty-seven percent of the companies are concentrated primarily in five states: New York, Florida, Delaware, California, and Texas. Comparing the industrial sectors to which companies in the US territory with Italian participation belong, the manufacturing industry is the predominant one, both in terms of number of companies (1,208) and revenues generated (over 27 billion Dollars, or 70 percent of the total). This is followed by the services, wholesale trade and construction sectors.

Please give our readers a summary of the data emerging from your study regarding the trade relations between Italy and US states

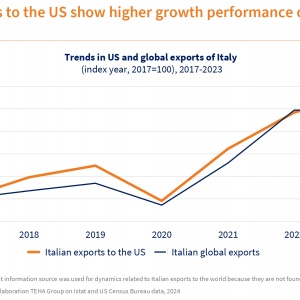

The trade relationship between Italy and the US is very strong and dynamic, with growth of Italian exports to the US outperforming average growth of total Italian exports (+46% vs +39% between 2017 and 2023); moreover, among non-EU destination, the US are 1st for value of Italian exports (equal to 67 billion euros in 2023).

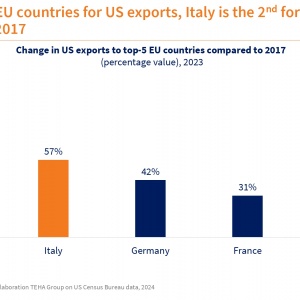

At the same time, the growth of US exports to Italy outperforming the growth of total US exports (+57% vs +30% between 2017 and 2023) and, among top-5 EU countries for US exports, Italy is the 2nd for growth compared to 2017.

Another important topic addressed in your report is an overview of US investments in Italy.

In 2023, US foreign direct investment in Italy amounted to 20 billion euros, up +26% from 2018, making it the second largest non-European country, after Switzerland, in terms of investment value. Additionally, Italy is the fourth country where the US has increased investment the most in the past year.

On the other hand, analyzing the presence of US companies in the Italian territory, the US is the second country in the world in terms of the number of foreign-controlled companies in Italy (first in the industrial sector) and first in the world in terms of the number of people employed.

In fact, in 2021, in Italy there were more than 2,500 US-controlled companies employing more than 333,000 people, with a growth rate since 2017 of +10% and +17% respectively.

Vice versa, what about the Italian investments in the US?

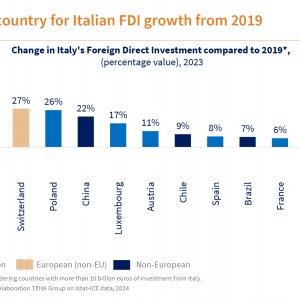

The United States are the 1st most relevant non-European country for outbound FDIs from Italy (65 billion euros in 2023) and the 1st country for Italian FDI growth from 2019 (+44%).

Your study also tells about some of the major incentive programs available at the American federal and state level…

The US offer significant development opportunities for Italian companies through numerous programs and incentives available at the federal and state levels. Some of the major programs available at the federal level in the areas of specialization include the CHIPS and Science Act ($280 billion), the Infrastructure Investment and Jobs Act ($1.2 trillion) and Inflation Reduction Act ($370 billion), the Defense Manufacturing Community Support Program ($80 million), and the Infrastructures for bioindustrial production ($1 billion).

In addition to numerous incentive programs, US states offer a high degree of flexibility – "competing" with each other to attract businesses and jobs – and collaboration with investors.

According to your experience, what was the most surprising trend or pattern that emerged from your analysis?

It was impressive to discover how broad the distribution of Italian companies throughout the US is. Analyzing their presence more in depth, we acknowledged how the most relevant opportunities stem from the consolidated presence of industrial excellence, know-how, and ability to collaborate.

Based on your findings, what are the top challenges that Italian companies face when trying to enter the US market, from a data-driven perspective?

One major challenge is adapting to US consumer preferences—while Italian products are known for quality, often American consumers prefer local goods when available, and pricing plays a big role in purchasing decisions.

Regulatory compliance is another hurdle, especially in the food sector. The FDA rejects 15-20% of imported food products due to labeling or ingredient issues, so companies need to invest in legal expertise to meet US standards. Finally, operational costs can be high. Setting up a local presence in the US is often 30-50% more expensive than operating from Italy, making it crucial for companies to decide whether to open offices or work through distributors.

Despite these challenges, Italian companies that leverage innovation, strategic partnerships, and adequate professional support have demonstrated their capability in successfully navigate the US market.

It now seems certain, even based on the statements of the new Trump presidency, an impending increase in duties on goods exported to the United States, which could affect several sectors of Italian-made goods. What happened in the past to Made in Italy exports to the US when duties were put in place, and what do you think will happen this year?

While past US tariffs have created challenges — raising costs and impacting competitiveness — Italian exporters have always shown resilience. This time, many are proactively adapting by accelerating shipments, diversifying markets, and optimizing pricing strategies.

If new duties are imposed, there may be short-term hurdles, especially for some sectors. However, strong demand for Italian excellence will help mitigate the impact. Italian businesses are well-prepared to navigate these changes and continue thriving in the US market.

TEHA Group has a very good understanding of the Italian American community. In your opinion, what role can the 20 million Italian Americans play in the dynamics that are the subject of your study?

Basically, the Italian American community act as a “bridge” between the Italy and the US and facilitate the process of foreign marketing by providing information about both their country of origin and destination and overcoming the information barrier.

In addition, promoting the reputation of the country of origin in the country of destination is a very important contribution that Italian descendants make to Italy and to the positioning of “Made in Italy” products. In fact, according to recent studies, there is a direct link between the level of immigration to a country—considered as diaspora—and the level of exports.

Specifically, it is estimated that for every 1 percent increase in the immigrant population in a destination country, thanks to new trade relations and investment and the creation of increased demand and better promotion of products stimulated by the diasporic community settled in the destination country, an increase in manufacturing exports from the country of origin of up to +1.7 percent can be achieved.

You may be interested

-

‘Fuggedaboudit’ the motto of new Italian del...

By Kimberly Sutton Love is what brought Tony Nicoletta to Texas from New York.The transpl...

-

“The Art of Bulgari: La Dolce Vita & Beyond,...

by Matthew Breen Fashion fans will be in for a treat this fall when the Fine Arts Museums...

-

13th Annual Galbani Italian Feast of San Gen...

In September of 2002, some of Los Angeles' most prominent Italian American citizens got to...

-

1st Annual Little Italy Cannoli Tournament

Little Italy San Jose will be hosting a single elimination Cannoli tournament to coincide...

-

An Unlikely Union: The love-hate story of Ne...

Award-winning author and Brooklynite Paul Moses is back with a historic yet dazzling sto...

-

Buon Appetito! Unique Italian dining at Ragú...

There's something to be said for having your food prepared tableside. Guacamole tastes fre...

-

Candice Guardino Brings GILDA AND MARGARETTE...

Candice Guardino is adding to her list of successful theatrical productions with the debut...

-

Cathedral of St. John the Divine, Oratorio S...

For the first time ever, The Cathedral of St. John the Divine, in collaboration with the O...